When someone wanted money to start anything—a project, a business, or anything else—they had a finite number of possibilities. To take on debt, they would need to get a loan. People they know, such as angel investors or venture capitalists, may be able to help them get money. They might even try “bootstrapping” or funding the project with whatever they can gather on their own.

In the late 2000s, crowdfunding became a viable fourth option for business owners looking to start an enterprise.

Crowdfunding is popular for startups and growing businesses looking for low-cost, quick finance. It’s a clever way to raise money for projects that are still in the early stages.

Another result is that your product will gain a following. The online community can be used to do market research and attract new clients.

This guidebook will be helpful to business owners, operators, and companies of all sizes, particularly those in the micro to medium-sized range. If you are thinking about how to fund a new idea or business or if you have heard of crowdfunding and are interested in it, you might find this tutorial useful.

Table of Contents

Why Do People Crowdfund?

Crowdfunding is a method of raising capital for businesses in which many people each make a small financial contribution. By expanding the pool of investors beyond the traditional suspects, such as business owners, friends and family, and venture capital firms, crowdfunding, which links investors and entrepreneurs through social media and other online platforms, has the potential to encourage entrepreneurship.

Any goal, including but not limited to charitable initiatives, creative endeavours, business endeavors, educational expenses, and individual necessities, may be funded through crowdfunding.

crowdfunding types

There are four different types of crowdfunding, but they all depend on monetary donations from people and organizations who want to support the cause. So let’s examine how they are divided up:

Donation

Backers of projects funded by voluntary financial donations do not receive any products or services in return. You decide to start a crowdfunding campaign to finance the purchase of new equipment for your company. People who give you money do it solely to support your company’s growth.

Debt

Crowdsourcing includes debt-based donations or peer-to-peer lending. The money pledged by backers in debt-based donations is a loan that needs to be repaid with interest by a specific date.

Rewards

Here, a financial favour is returned by providing the giver with a concrete advantage. The rewards are dependent on the gift amount, which encourages larger donations. In exchange for financial assistance, participants may be given a T-shirt, a good, or a service, occasionally at a reduced price.

Equity

Equity-based crowdfunding enables small businesses and startups to give away a percentage of their company in exchange for money. However, some crowdfunding campaigns do not allow supporters to own a stake in the company they are supporting. These donations represent an investment, with the contributor getting a share in the business in exchange for their funds.

actual estate

Investing in their projects is a terrific way for people to enter the real estate industry. This is useful for those who are interested in real estate investing but don’t want to engage with mortgage brokers, realtors, or contractors. Crowdfunding for securities falls under this.

People Resources

People can get financial support for their projects or endeavours through human capital crowdfunding. Investors are allowed to support a project and profit financially from their involvement. For instance, many poker players solicit audience funding to play the game and then give back some of their winnings to their backers.

What Makes Crowdfunding Unique?

Regarding financing a business, crowdfunding is effectively the opposite of the standard method. In the past, if you wanted to raise money to start a firm or introduce a new product, you would need to gather your prototypes, market research, and business plan and then pitch your idea to a select group of wealthy people or organizations.

You could raise money from banks, private investors, and venture capital firms, which reduced the number of prospective backers to a small number. You and your proposal could be pictured as the top of a funnel in this way of raising funds, with possible investors at the bottom. You’ll only use both if you guide that funnel toward the right investor or company at the right time.

Crowdfunding websites, however, turn the traditional pyramid on its side. This approach streamlines the conventional paradigm by giving you, the business owner, a central location to produce, display, and distribute your pitch materials. Finding investors required months of work and money spent on networking and evaluating possible sponsors. With the help of crowdfunding, you can easily reach a wider audience with your business plan and offer backers a variety of investment choices, from thousands of dollars in exchange for shares to as little as $50 in exchange for a first-run item or another incentive.

How is crowdsourcing Done?

Websites that promote communication between fundraisers and the public are known as crowdfunding platforms. Use the crowdfunding website to ask for and gather donations of money.

If a campaign for crowdfunding is successful, the platform will frequently charge the fundraiser a fee. Users rely on crowdfunding websites to be secure and easily used in exchange.

Many websites demand full payment or nothing in terms of money. This guarantees that there won’t be any negative emotions or monetary loss, whether or not the aim is accomplished.

Here are a few different types of crowdsourcing that are described. The three most common types used by for-profit SMEs and startups are peer-to-peer, equity, and incentive crowdfunding.

The Benefits of Crowdsourcing

Crowdfunding may be a fantastic substitute for taking on debt or selling stock in a firm early on. There are several top-notch venues for crowdfunding, and the process is typically simple.

The following list outlines five advantages of business crowdfunding.

High Potential Payoff with Low Risk

Your company will only lose the money used for administrative charges if your crowdsourcing campaign fails. The campaign’s successful conclusion could result in significant financial gains. Since the funds generated through crowdfunding do not need to be repaid, it is a lower-risk option than taking out a loan for a startup company.

A Higher Number of Occurrences

Startups frequently need more substantial PR and advertising personnel. Another benefit of starting a crowdfunding campaign is that it will be more well-known, attracting more customers and financial backers. Many news sites will write about your idea if you have many supporters.

A group with a Specific Audience and Centralized Message Distribution

Social networking for your business can only reach as far as its current fan base. Established individuals can find your product or service through a crowdfunding campaign and learn more about it.

Additionally, it offers a single location for all campaign-related communications, saving you the time and effort of having to alert everyone individually to every new development. This technique saves both time and money.

establishing ties and gathering viewpoints

Organizing a group of individuals who are enthusiastic about your product can help you attract potential clients and will offer quick feedback and testing. While some of the comments may be pointless, others will be useful in pointing you in the direction of adjustments that will increase the long-term viability of your business.

You are not required to forfeit your company’s equity

You should trade some of your company’s equity for cash when looking for alternative startup financing. With most crowdsourcing techniques, rewards other than ownership, such as cash or goods, can be given. This offers you complete ownership of the business and all of its profits while preventing you from working with partners who could have interests that conflict with your own.

Keep in mind that some rules and laws apply to the use of equity crowdfunding. Consult an attorney before starting a campaign for equity crowdsourcing.

The Drawbacks of Commercial Crowdfunding

Crowdfunding has its drawbacks, even if it might be useful for financing startup companies or innovative products. Crowdfunding projects come with much pressure and other risks and only sometimes succeed.

Consider these five drawbacks of business crowdfunding.

The likelihood of success could be a lot higher

While many people give crowdsourcing a shot, the majority are unsatisfied. Two of the many reasons why so few campaigns are successful: are poorly planned or timed campaigns and those without a strong crowdfunding business model.

Significant Time Required for Preparation

It takes much planning to run a successful crowdfunding campaign. In R&D, a product prototype is frequently necessary. Films, advertisements, explanations, donation tiers, and rewards are just a few of the components to consider and develop. Additionally, the business needs to have the staff on hand to answer customer enquiries right away once the advertisement is live. To do any of these tasks will take time and effort.

Having Issues Making an Impact

Even if investors use one of the most popular sites for crowdsourcing, they might not accidentally run into a campaign. After starting your campaign, the following step is to generate buzz to drive traffic to your website. While this is simpler with a centralized campaign site, manual labour is still necessary, which can be expensive and time-consuming.

High Prices and Strict Regulations

The main source of income for these platforms comes from the fees that organizations pay to utilize them to support initiatives. Most of these platforms deduct a fee of around 5% from the final total of a profitable campaign. Therefore, if you raise $200,000 in donations, the website will remove $10,000 from your total.

Campaigns on these platforms must go by some rules. Due to these limitations, you cannot customize your campaign or provide as many incentives as possible. For everyone’s protection, there are more restrictions in place for equity crowdfunding.

Initial Expenses Are Heavy

Crowdfunding campaigns could have expensive initial costs. You must create marketing materials for the campaign, such as logos, promos, and ads. Before starting the campaign, you must budget for these expenses because you won’t be able to get your money back if it fails.

How to make the most of your fundraising efforts

How can the upcoming crowdfunding opportunity be maximized?

The goal

Learn exactly how the campaign’s sponsor plans to put the funds to use.

The Team

Increase the likelihood of the business succeeding as much as you can. Investigate the founders, advisors, and team history to see whether the entrepreneur has the right people on board to carry out their goal or is setting themselves up for failure in the future.

Unique Value Proposition

Look for companies that can disrupt an established market or have a cutting-edge technical approach. Determine their unique value proposition (UVP), look into what makes them stand out, and ensure they provide the market with something fresh and novel.

Observe consumer behaviour and market trends

A product or service can only be considered exceptional if consumers are interested in it. The market they want to target has been researched. Is there room for expansion or a need for their product? By looking at its traction, it may be possible to learn how well the company’s product is selling in test markets.

Fraud

Always confirm the legitimacy of the firm’s website, filings, and other documents. Be sure to click on the first opportunity that pops up on social media.

Common Websites for Crowdfunding

Every year, hundreds of thousands of users who want to start something big or support something big utilize crowdfunding websites like Kickstarter, Indiegogo, and GoFundMe.

GoFundMe

Most people utilize GoFundMe out of all crowdfunding websites as of 2021. More than 100 million people have donated over $15 billion to GoFundMe since its launch in 2010.

Many people come to GoFundMe after a traumatic occurrence, such as a house fire, a natural disaster, or an unexpected emergency cost, to help them recover financially. Kickstarter, a platform for crowdsourcing, is used by many startup companies.

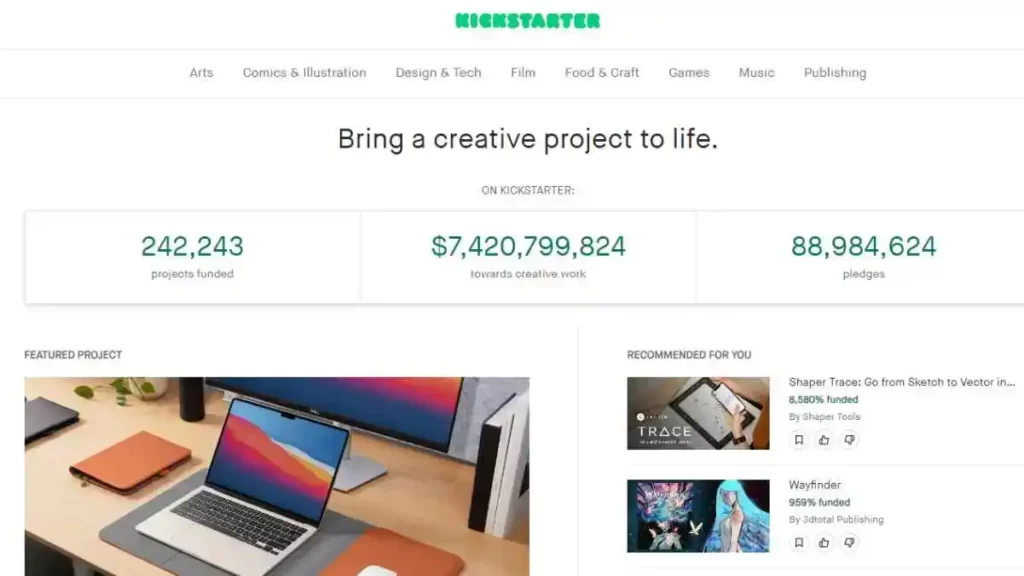

Kickstarter

Utilizing the crowdsourcing website Kickstarter is another option. Over 220,000 projects have received funding through Kickstarter since it launched in 2009, and more than $6.6 billion has been donated. The platform had surpassed its highest financing target as of May 29, 2022.

Check out Kickstarter if you’re looking to start a new business, need to raise some seed money, or want to attract more customers. Unlike GoFundMe, Kickstarter is restricted to use for public projects only.

Nothing on Kickstarter’s list of prohibited items, which includes “any item claiming to diagnose, cure, treat, or prevent an illness or condition, political fundraising, drugs or alcohol, contests, coupons, gambling, or raffles,” may be offered as incentives, including equity, revenue sharing, or investment opportunities.

Indiegogo

The indie film industry was the main area of support for the crowdfunding site Indiegogo when it initially came up in 2008.

Indiegogo, which allows the campaigner to get funding pro-rata or wait until the goal is attained, appears to be a more flexible and adaptable platform than Kickstarter, in part because donors can support either a fixed or flexible model on Indiegogo, in contrast to Kickstarter, which only provides funds after the goal is reached.

For a candidate seeking office, flexible fundraising (i.e., accepting donations as they come in) may seem like a safer and more practical option; however, candidates are still accountable for meeting all of their obligations regardless of the amount of money they receive. For a supporter, fixed money is more alluring as it is associated with significantly less risk.

Conclusion

A strong customer and investor base is necessary for any company’s long-term viability, and a successful crowdfunding campaign may help facilitate this. Many crowdfunding efforts fall short of their goals, and even those that succeed might encounter challenges if pledges still need to be fulfilled. Getting advice from professionals is advised before deciding to participate in a crowdfunding campaign.